August 2, 2023

During the first quarter of 2023, the medical device industry experienced notable market growth with a series of remarkable deals within the therapeutic devices sector, which grossed over £2.62 billion.

Therapeutic devices are specialised tools, instruments, or apparatuses designed to diagnose, treat, or manage various medical conditions. These devices are crucial in delivering accurate, efficient, and personalised care to patients. They contribute to improved patient outcomes, patient safety, enhanced quality of life, and overall technological advancements of healthcare practices.

These deals not only highlight the increasing need for advanced medical devices and the impact of the COVID-19 pandemic on health care providers, but also underscore the rapid progress of innovation propelling the healthcare industry towards a more patient-centric future.

1. Carmell Therapeutics

US based company Carmell Therapeutics is currently in the process of being acquired by Alpha Healthcare Acquisition Corp; a special purpose acquisition company formed for the purpose of effecting a business combination with one or more businesses in the healthcare sector, for £270.22M, and was announced on the 5th Jan 2023.

Carmell is a phase 2-stage biotechnology platform company developing allogeneic plasma-based biomaterials for bone and soft tissue healing indications. After a tough period between December 2020 and May 2021 where they reduced their number of employees by 58.33% to reduce expenditure and remain financially viable amidst the pandemic, they have started to see a positive recovery, increasing their workforce from 11 to 18 employees in recent months with signs of continued growth.

The acquisition is being spearheaded by Rajiv Shukla, who has been Chairman and Chief Executive Officer of Alpha Healthcare Acquisition since its inception and has over two decades of investment and operational experience in the healthcare industry. Having served as Senior Director at Pfizer, Inc. (NYSE:PFE) from 2001 to 2006, he played a key part in several acquisitions including Pharmacia in 2003, Meridica in 2004, Vicuron Pharmaceuticals and Idun Pharmaceuticals in 2005, and Rinat Neuroscience in 2006.

Randolph Hubbell, who will serve as Chief Executive Officer of the combined company, brings over 20 years of sales and strategic marketing experience from working for medical technology companies. A seemingly indomitable force, his experience as Vice President of Worldwide Marketing at Ethicon Biosurgery and oversight of global commercialisation, coupled with his 14 year stint as Senior Sales and Marketing Executive at Johnson & Johnson positions the company well for sustained, stable success.

The market capital of the merger is projected to reach around $328 million, and it is estimated that the current shareholders of Carmell will own approximately 46% of the issued and outstanding shares in the company. The business is also expected to receive gross proceeds of approximately $154 million upon transaction closing.

2. SeaSpine Holdings

The 5th of January was a busy day for deals in the medical device industry, with SeaSpine Holdings being snapped up by leading global spine and orthopaedics company Orthofix International for £270.05 million on this date.

The acquisition will lead both companies to merge, with Orthofix shareholders holding 56.5% shares, whereas those with a stake in SeaSpine receive a 43.5% share. The merged business will be renamed at a later date and until then will continue to be known as Orthofix Medical Inc. The organisation will have a combined workforce of approximately 1,600 employees, with products distributed in 68 countries globally, and a global R&D, commercial, and manufacturing footprint.

Current Worldwide President of Biomet Biologics and Sr. Vice President of Biomet, Jon Serbousek continues to serve as Executive Chairman at Orthofix. Jon is well versed in the spine and orthopaedics segment, and has an outstanding ability to innovate, demonstrated by the generation of over 18 patents and numerous applications in process.

Former SeaSpine CEO and President, Keith Valentine, has since transitioned into CEO and board member of Orthofix post deal completion. Having overseen the formational spin-off transaction of SeaSpine, Keith has been well placed to lead Orthofix through its post-deal integration and strategic growth initiatives.

3. Limacorporate

Italian therapeutic device company Limacorporate, who provide a range of orthopaedics and traumatology surgical instruments and devices as well as implantable prostheses, received £260.50 million of senior secured floating rate notes and senior revolving credit facility from undisclosed lenders on 6th February 2023.

The proceeds from the note offering and drawings under its new revolving credit facility will be used to repay outstanding debt, which marks the second time the company has refinanced debt since 2017 when they refinanced £245.01 million.

This is the company’s first deal completed under the supervision of their current CEO Massimo Calafiore, who joined the company in September 2022. Massimo has accrued a wealth of experience in the orthopaedics segment from his time spent as Chief Commercial Officer at NuVasive, where he was responsible for the company’s specialised orthopaedics business unit, amongst others. He also gained knowledge of the prosthetics industry through the various leadership roles he held from 2008 to 2017 at Waldemar Link GmbH & Co. KG, a company which produced the first ever joint replacement prosthesis made in Germany.

Previous Limacorporate CEO, Luigi Ferrari, has remained in the orthopaedics sphere and is now a senior advisor & investor of G21 srl, an innovator in the bone cement market for orthopaedics and minimally invasive spine surgery.

4. Insight Lifetech

Chinese based company Insight Lifetech has been in IPO registration on the Shanghai Stock Exchange since 24th March 2023, and is expected to raise £152.78M.

The therapeutic device company, which develops and manufactures heart intervention medical technology intended to improve cardiovascular disease diagnosis and therapy, has seen exponential growth since its inception in 2015. From 87 employees at the end of 2019, they have exploded, now employing 522 people, an increase of 500% in less than 4 years.

Their rapid success can likely be attributed to its synergistic platform that seamlessly integrates its R&D, manufacturing, and commercialisation capabilities, enhancing collaboration across functions, speeding up product development, achieving cost-efficiency, and promoting innovation. Additionally, Insight Lifetech also created the first and only domestic fractional flow reserve (FFR) system in China that was approved by the NMPA, giving them a major competitive advantage in the medical devices market. The IPO will raise the largest amount of money the company has raised from a single deal, and approximately double the total capital they have raised to date.

Insight Lifetech’s CEO & Chairman, Liang Song has also contributed to the round. With over 19 years of hands-on research and development experience with a variety of imaging and diagnosis systems development, as well as a PhD degree in Biomedical Engineering, he brings a deep understanding and proficiency in these areas to his role.

Liang possesses the technical knowledge and practical skills necessary to lead the development and enhancement of FFR systems which commonly implement photoacoustic, optical, and ultrasonic imaging techniques. His exceptional educational background, coupled with his extensive experience in therapeutic devices, positions him as a highly qualified leader to guide Insight Lifetech towards innovative advancements in the field of cardiovascular disease diagnosis and therapy.

5. Sahajanand Medical Technologies

Sahajanand (SMT) was rolled into a continuation fund by Samara Capital, a private equity firm based in Mumbai, India, through a £123.79M million deal on 9th January 2023, with TR Capital also participating in the round.

SMT manufactures minimally invasive coronary stent systems designed to make critical healthcare affordable to its clients. The company offers ultra-thin stent coronary intervention, structural heart and peripheral medical devices made with a biodegradable polymer matrix.

Their current Chairman and founder of SMT, Dhirajlal Kotadia, has worked for the company for over 34 years. Over the course of three decades, he has founded and developed several medical device companies, in addition to businesses in the technological and pharmaceutical industries.

Having led the Sahajanand Group for over 20 years, guiding SMT to becoming India’s only and largest manufacturer of cardiovascular medical stents of international quality in that time, he possesses an unparalleled understanding of the therapeutic devices sector both domestically and internationally. This profound industry knowledge and experience positions him as a formidable leader, capable of steering the company towards continued growth and success as one of India’s largest medical device manufacturers.

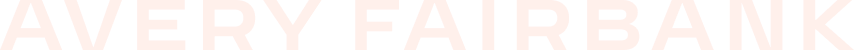

If you’re interested in further in-depth analysis of the medical devices industry; including deals, key players, trends and challenges from the last year and quarter, you can register interest for our exclusive Market Analysis Report.

Published on 02-08-2023